2024 Irs Form 1040 Schedule 1065

2024 Irs Form 1040 Schedule 1065 – Form 1065 is used by domestic and some foreign partnerships to declare profits, losses, deductions, and credits for their tax year. Form 1065 is used by domestic and some foreign partnerships to . Small businesses that are sole proprietorships, partnerships or limited liability corporations are allowed to deduct costs for workers’ compensation insurance from their federal and state taxes. .

2024 Irs Form 1040 Schedule 1065

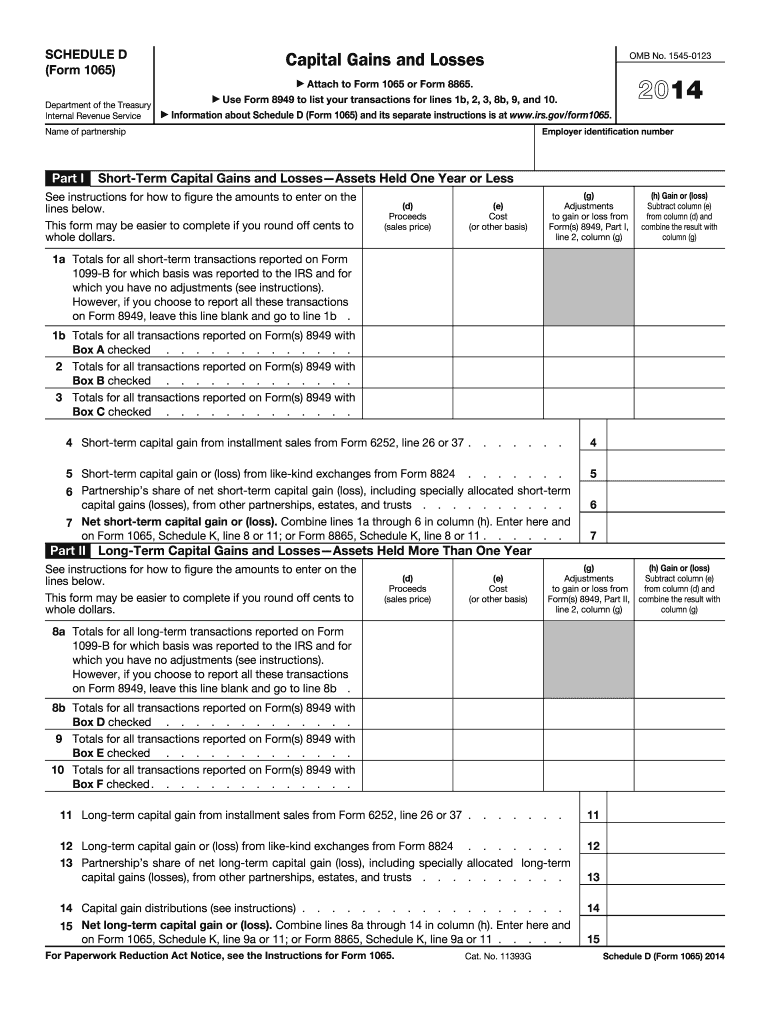

Source : thecollegeinvestor.com2022 2024 Form IRS 1065 Schedule D Fill Online, Printable

Source : 1065-d.pdffiller.comBusiness tax deadlines 2024: Corporations and LLCs | Carta

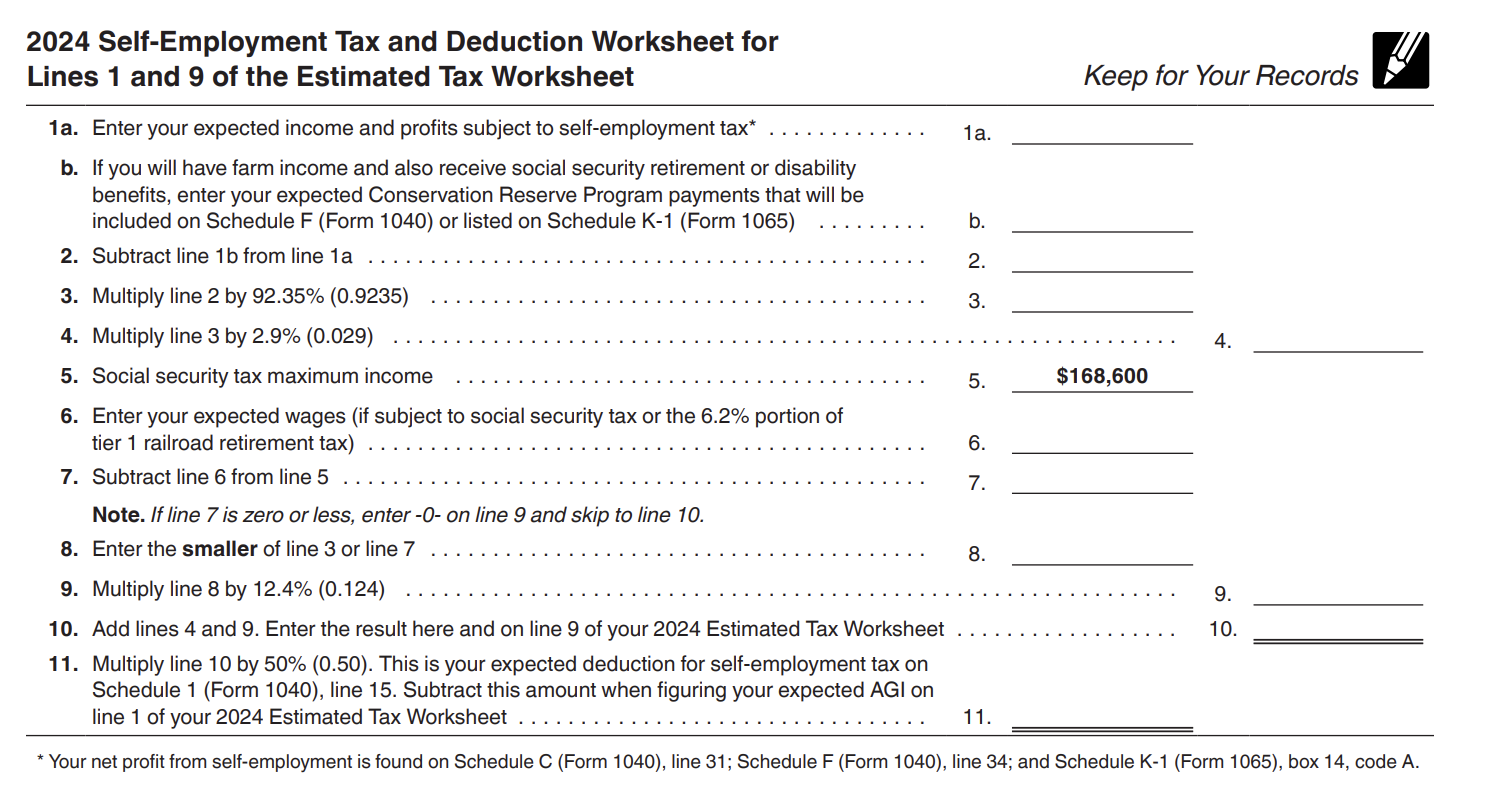

Source : carta.comEstimated Taxes, Due Dates and Safe Harbor Tax Rules (2024)

Source : wallethacks.comTiktok vs Instagram🔥🔥🔥 Billy McFarland, founder of the most

Source : www.instagram.comTop Tax Software for Tax Preparers in 2024 Ultimate Guide

Source : www.freshproposals.comFiling your taxes with me is real easy ! Step 1 Upload

Source : www.instagram.comIRS 1065 Schedule K 1 2020 2024 Fill out Tax Template Online

Source : www.uslegalforms.comLegacy Financial Services: Tax Resources

Source : www.legacyfsc.comSchedule d form 1065: Fill out & sign online | DocHub

Source : www.dochub.com2024 Irs Form 1040 Schedule 1065 Tax Due Dates For 2024 (Including Estimated Taxes): You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. . In other words, taxpayers with uncomplicated tax situations will likely fill out Form 1040. Your 1040 will come with a number of schedules – like Schedule 1 and Schedule A – that are .

]]>