Schedule A 2024 Form 1040

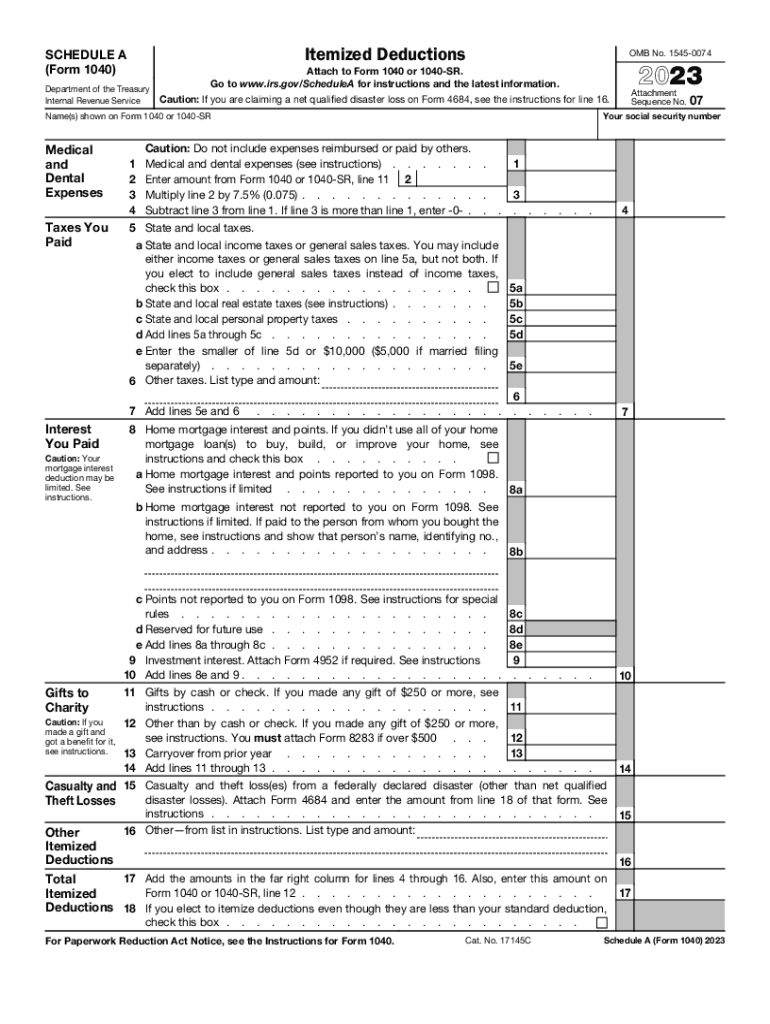

Schedule A 2024 Form 1040 – Tax season — with its homeowner tax benefits — is one of the few times you may actually get some money out of your house instead of pouring money into it. Owning a house in the . (early 2024). A copy of this form will also be sent to the IRS. In most cases, homeowners can report the amount on this form on line 8a of Schedule A (Form 1040). However, the allowable deduction .

Schedule A 2024 Form 1040

Source : www.incometaxgujarat.orgPrintable IRS Tax Forms for 2023, 2024: Simplifying Tax Season

Source : fox59.comAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.com2024 Form 1040 ES

Source : www.irs.govForm 1040: U.S. Individual Tax Return Definition, Types, and Use

Source : www.investopedia.comHarbor Financial Announces IRS Tax Form 1040 Schedule C

Source : www.kxan.comForm 1040 For IRS 2024 | How To Fill Out Schedule A B C D

Source : nsfaslogin.co.zaIRS Tax Form 1040 SR Instructions and Printable Forms for 2023 and

Source : www.abc27.com2023 Form IRS 1040 Schedule A Fill Online, Printable, Fillable

Source : irs-form-1040-schedule-a.pdffiller.comForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.orgSchedule A 2024 Form 1040 Form 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions : Here’s our guide to the mortgage interest deduction for homeowners, just in time for the 2024 tax season you’ll need to fill out a Schedule A form and attach it to your Form 1040 when you file . The money you win from placing bets on your favorite sports team is considered income, no matter how little. The IRS considers all winnings from gambling fully taxable, whether from a website, app, .

]]>

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)

:max_bytes(150000):strip_icc()/Screenshot2023-12-15at12.57.18PM-4df7a66986cf4a1ab5cc962b78b698fd.png)